are raffle tickets tax deductible australia

This means that purchases from a charity that involve raffle tickets items or food cannot be claimed as tax deductible gifts. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense.

Pin On Cover Letter Templates Design

The result of this is that individuals whose purchases involve raffle tickets items or food cannot benefit from an.

. Are raffle tickets tax deductible Australia. From income to state tax heres what you need to know about taxes. Are lottery tickets tax deductible in Australia.

This is because the purchase of raffle tickets is not a donation ie. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. Jude Dream Home tickets arent taxdeductibleWhen you get a ticket youre signing up for a chance to win in a raffle.

The gift or donation. Complete answer to this is here. Find Out About The Measures Were Taking To Protect You At Every Step Of Your Journey.

In accordance with Australian Tax Office guidelines if you receive a lottery ticket in return for your transaction then your purchase cant be claimed as a deduction. Your Tips And Tricks To Saving Time And Money On Your Tax Return Abc News Australian Broadcasting Corporation - A raffle ticket or pen then it doesnt qualify as a tax deduction. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status.

The irs has adopted the position that the 100 ticket price is not deductible as a charitable donation for federal income tax purposes. However pins tokens wristbands and stickers are deemed by the ATO as having no material value and are used by the DGR as marketing and promotional material. Ad Book With Peace Of Mind Today With Our Increased Ticket Flexibility.

If your donation is accompanied by an experience perk the amount of your donation that is deductible for US. Some donations to charity can be claimed as tax deductions on your individual tax return each year. Are raffle tickets tax deductible if you dont win.

If however you give tickets that are less than 300 in value they are not tax deductible but they. People also ask has anyone won the dream house raffle. Most Australians have one or two charities that they feel passionate about.

If your chosen charity is on the DGR list that doesnt necessarily mean you can claim your donation on. If you lose the raffle the cost of your ticket might be deductible as a gambling loss. No lottery tickets are not able to be claimed as a tax deduction.

Basically if you receive something because of your donation then dont claim the donation as a tax deduction. Donations to these campaigns and platforms are not deductible. A gambling loss deduction is allowed only if you itemize deductions and only if you have gambling winnings from that tax year.

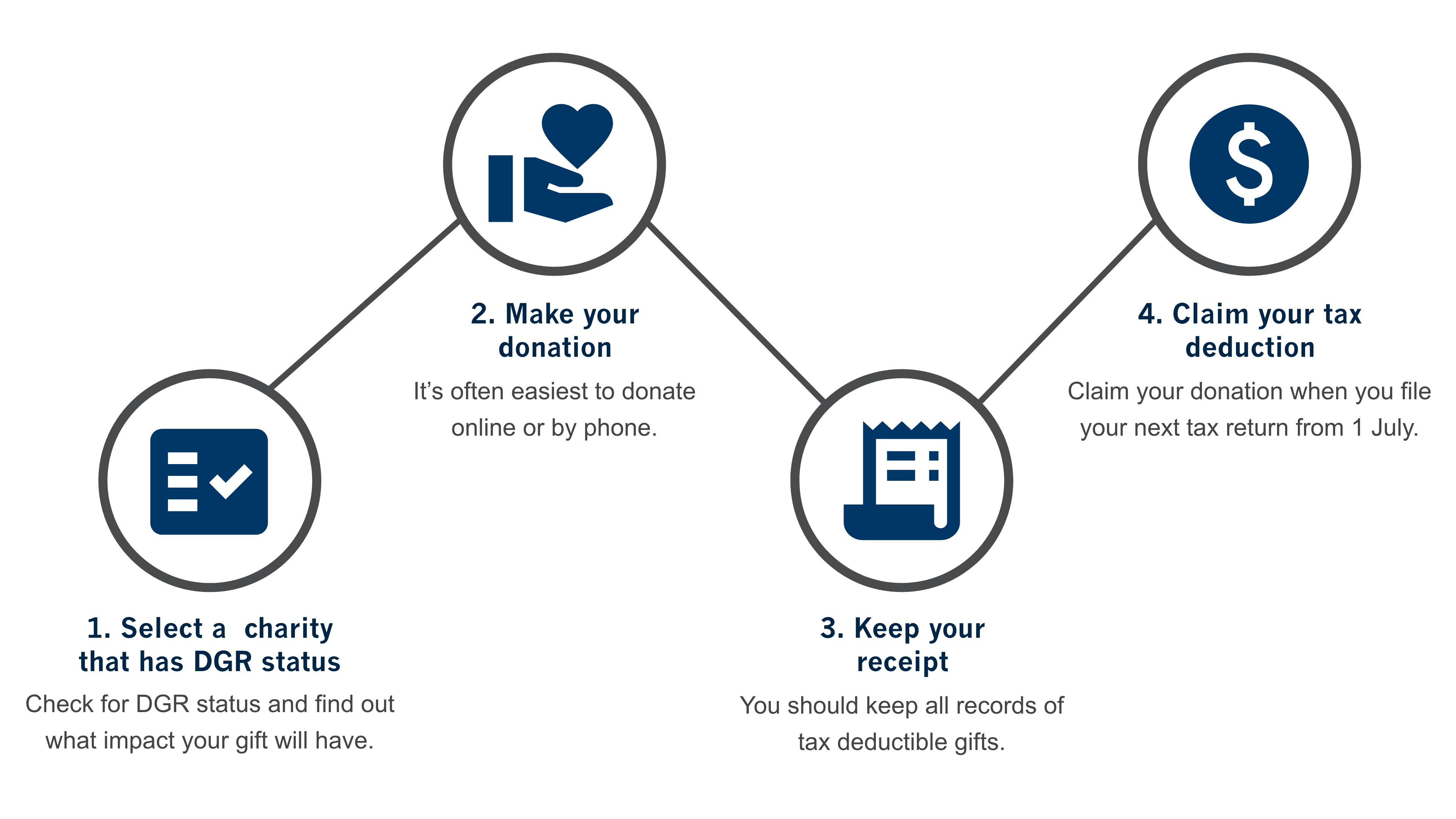

To claim a tax deduction for a gift or donation you make it must meet the following four conditions. In other words charities that sell raffle tickets items or food to raise money cannot benefit from tax-deductible gifts as they are not able to claim these deductions. A raffle is a game of chance where the prizes are either goods or cash or a combination of the two.

If you have any questions regarding your tax obligations you should consult with your own tax advisor. Are Raffle Tickets Tax Deductible Australia. Entertainment gifts that cost 300 or more are tax deductible but they are also subject to Fringe Benefit Tax FBT something to keep in mind if you have an extensive client portfolio or staff list you wish to provide with experiential gifts.

You can check the DGR status of an organisation at ABN Look-up. Find Out About The Measures Were Taking To Protect You At Every Step Of Your Journey. Federal income tax purposes may be limited to the excess of the amount contributed over the value of goods or services provided.

Ad Book With Peace Of Mind Today With Our Increased Ticket Flexibility. To determine if a charity has DGR endorsement visit the ACNC Charity Register. In accordance with Australian Tax Office guidelines if you receive a lottery ticket in return for your transaction then your purchase cant be claimed as a deduction.

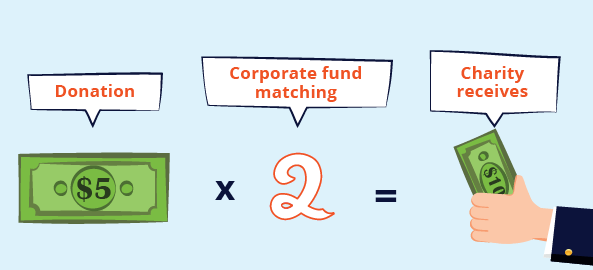

No lottery tickets are not able to be claimed as a tax deduction. Are Charity Donations Tax Deductible. Funds that are donated in exchange for benefits such as raffle tickets fundraising chocolates or fundraising dinner tickets however genuine are not tax deductible.

Why you cant claim raffle tickets or most crowdfunding donations. Thats because you are not actually making a charitable donation but are gambling on the chance that you have the winning ticket. When a gift or donation is deductible.

Generally you can claim donations to charity on your individual income tax returns. Shirley Juniphant won the top prize in the 2015 Dream House Raffle but since the ticket threshold wasnt reached that year the dream house wasnt offered as a. The sale of tickets in a raffle and the acceptance of a persons participation in a game of bingo by a registered charity gift deductible entity or government school are GST-free provided they do not contravene state or territory law.

On the whole were pretty generous when it comes to giving too over 80 of Australians give to charity every year. First of all if you receive a raffle ticket dinner attendance event entry chocolates or anything like that then your donation cant be claimed as a deduction. Must be made to a DGR.

Whether your charity is a grass-roots community initiative an issue thats touched you or your family or a cause that aligns with your. Deductible gift recipients External Link. Are raffle ticket donations tax deductible.

How much does go fund me keep from donations. In Australia raffles can only be run for the benefit of not-for-profit declared community or charitable organisations. This means that purchases from a charity that involve raffle tickets items or food cannot be claimed as tax deductible gifts.

Are Raffle Tickets Tax Deductible Australia.

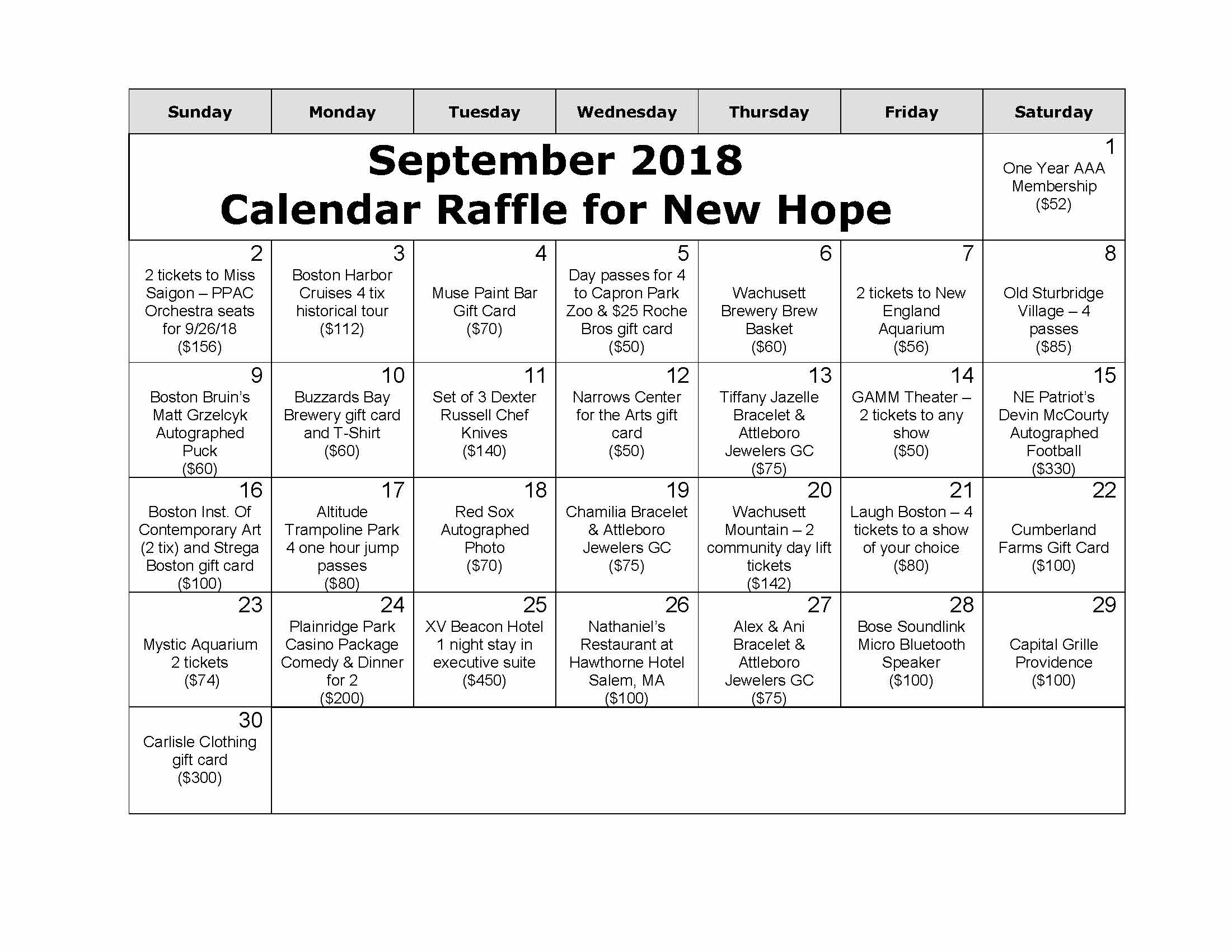

Raffle Cheat Sheet A Tool That Helps Volunteers Sell More Raffle Tickets Fundraising Gala Auctioneer Sherry Truhlar Raffle Raffle Tickets Auction Fundraiser

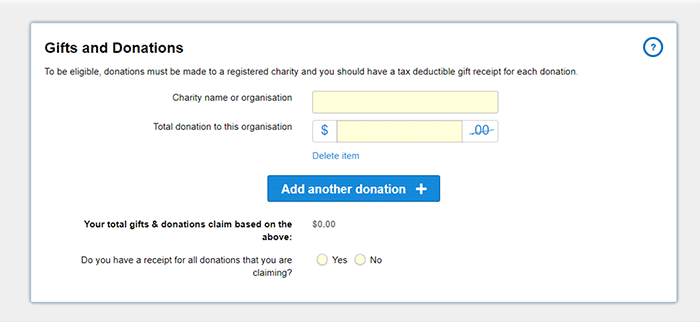

How To Claim Tax Deductible Donations On Your Tax Return

Marketing Outreach Plan Template Unique Donation Letter Raffle Ideas Pinterest Donation Letter Donation Letter Template Fundraising Letter

Donations And Deductions Bishop Collins

How To Claim Tax Deductible Donations On Your Tax Return

Are Charity Raffle Tickets Tax Deductible Australia Ictsd Org

Are Raffle Tickets Tax Deductible Australia Ictsd Org

Letter Requesting Donations For Silent Auction Download This Silent Auction Donation Reques Donation Letter Donation Letter Template Donation Request Letters

Are Charity Raffle Tickets Tax Deductible Australia Ictsd Org

Tax Deductible Donations Reduce Your Income Tax The Smith Family

How To Claim A Tax Deduction On Christmas Gifts And Donations

How To Know If Your Charitable Donations Are Tax Deductible

Sample Donation Letter Template For Tax Purposes Examples Sponsorship Letter For Fundraising Donation Thank You Letter Donation Letter Template Donation Letter

Tax Deductible Donations An Eofy Guide Good2give

Tax Deductible Donations An Eofy Guide Good2give

How To Claim Tax Deductible Donations On Your Tax Return

Cornhole Tournament To Benefit Relay For Life Follow Us On Twitter Lynne Schneider For Life Of Vinings Smyrna Ga Relay For Life Relay Cornhole Tournament